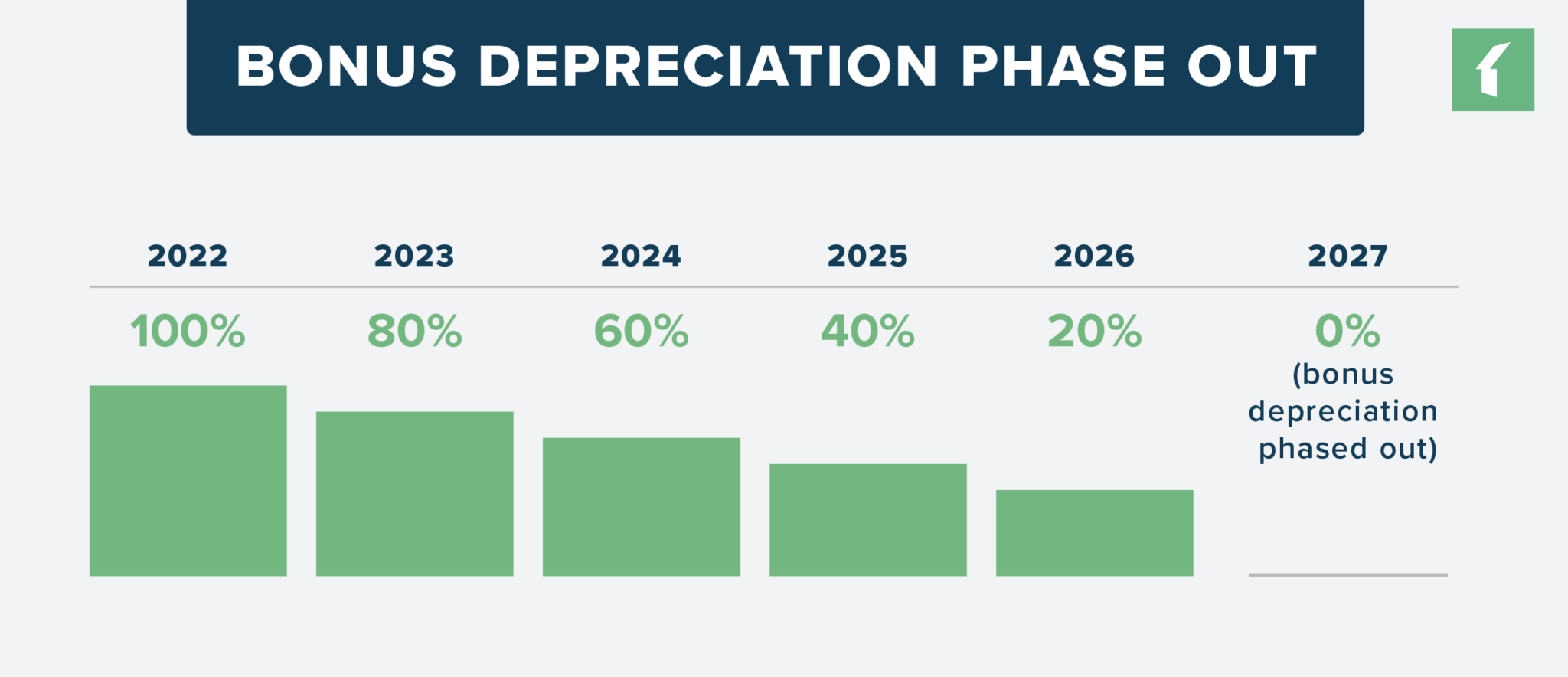

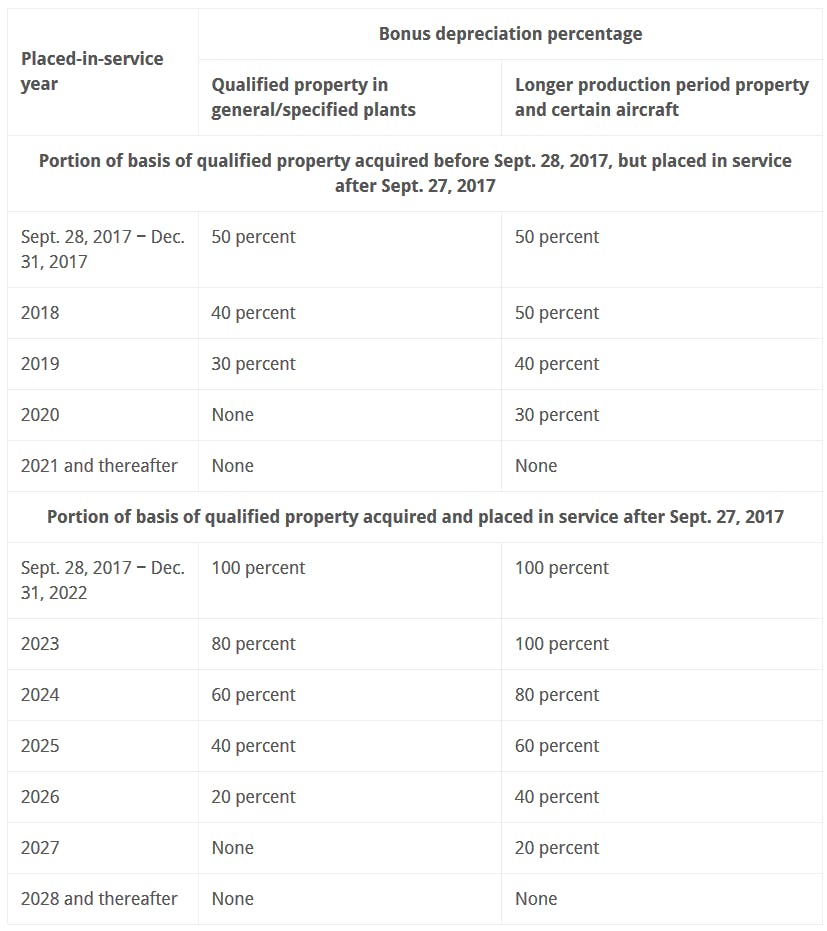

Bonus Depreciation 2025 15 Year Property. This means businesses will be able to write off 60% of. Bonus depreciation allows businesses to deduct a larger portion of the cost of qualifying assets immediately, rather than spreading it out over several years.

Bonus depreciation allows businesses to deduct a larger portion of the cost of qualifying assets immediately, rather than spreading it out over several years.

Bonus Depreciation Saves Property Managers Money Buildium, A taxpayer that elects out of bonus depreciation for qualified improvement property placed in service in a given year can depreciate qualified improvement property. These requirements are (1) the depreciable property must be of a specified type;

What Is Bonus Depreciation A Small Business Guide The Blueprint, A taxpayer that elects out of bonus depreciation for qualified improvement property placed in service in a given year can depreciate qualified improvement property. This limit is reduced by the amount by which the.

Rental Property Depreciation How It Works, How to Calculate & More (2025), Expense amount increased to $1,000,000. For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000.

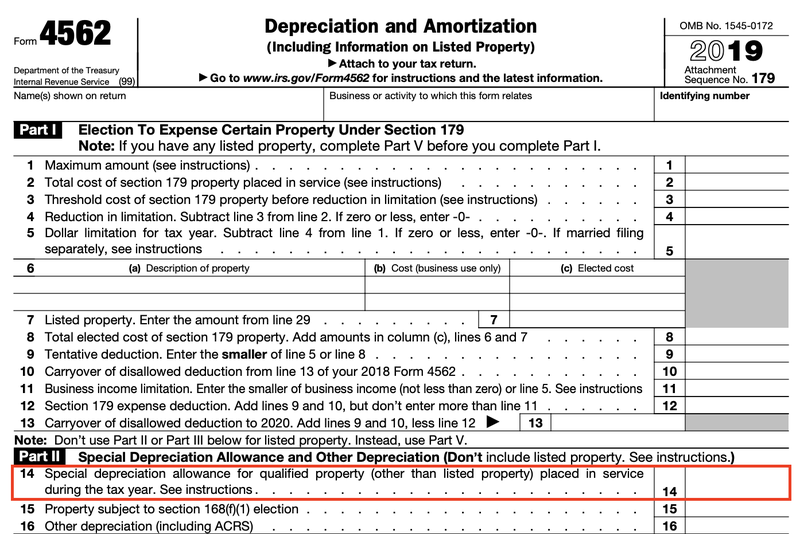

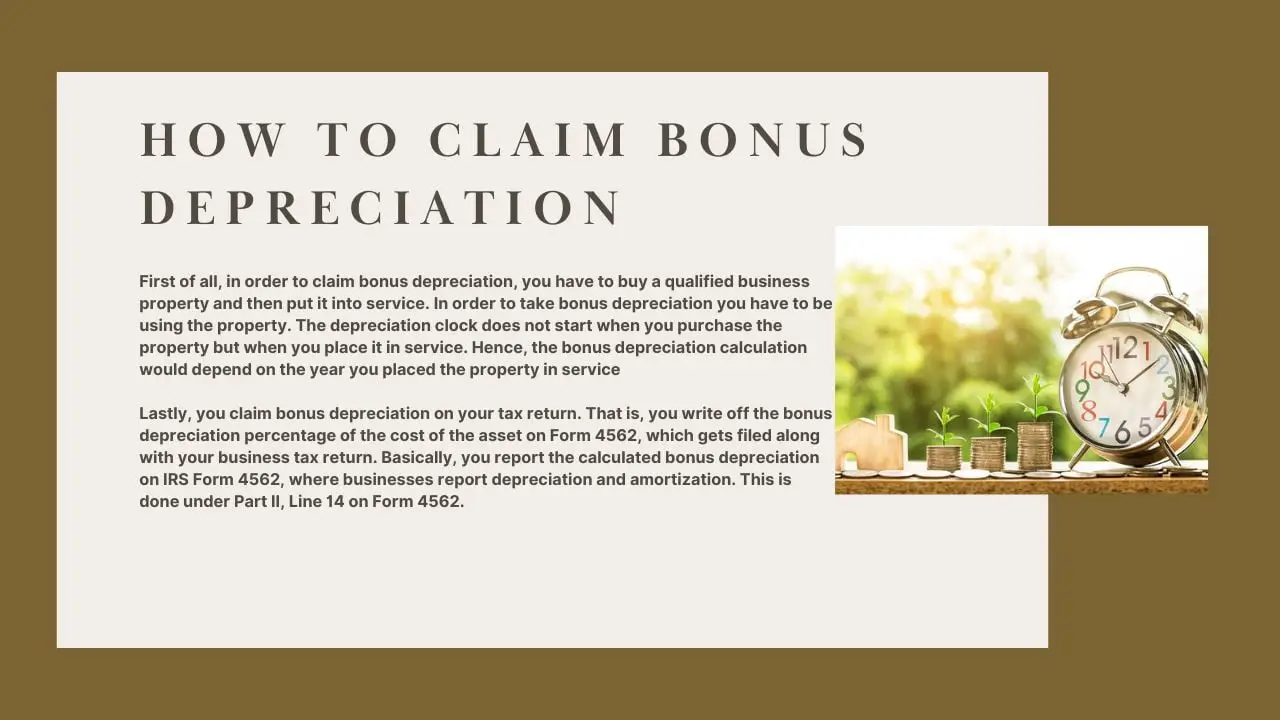

How to Claim Bonus Depreciation Financial, A taxpayer that elects out of bonus depreciation for qualified improvement property placed in service in a given year can depreciate qualified improvement property. This limit is reduced by the amount by which the.

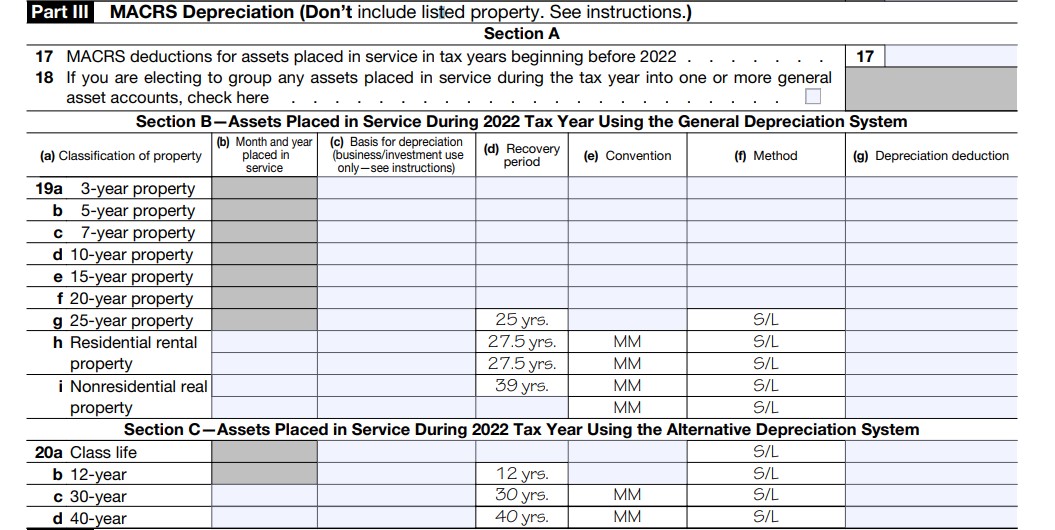

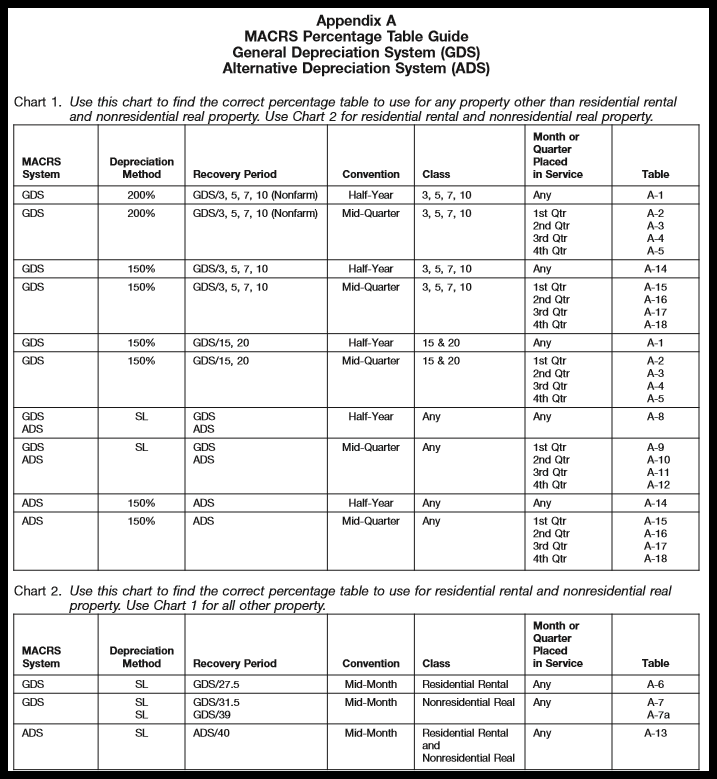

MACRS Depreciation Tables & How to Calculate, The bonus depreciation deduction under section 168 (k) begins its phaseout in 2025 with a reduction of the applicable limit from 100% to 80%. How is bonus depreciation set to change in 2025?

Bonus Depreciation Saves Property Managers Money Buildium, Here’s how it breaks down: How is bonus depreciation set to change in 2025?

Bonus Depreciation Rules For Rental Property Depreciation, 168 (e) (7) strategy for maximizing depreciation deductions. Here’s how it breaks down:

Bonus depreciation rules, recovery periods for real property and, In 2025, bonus depreciation allows for 100% upfront deductibility of depreciation; This means businesses will be able to write off 60% of.

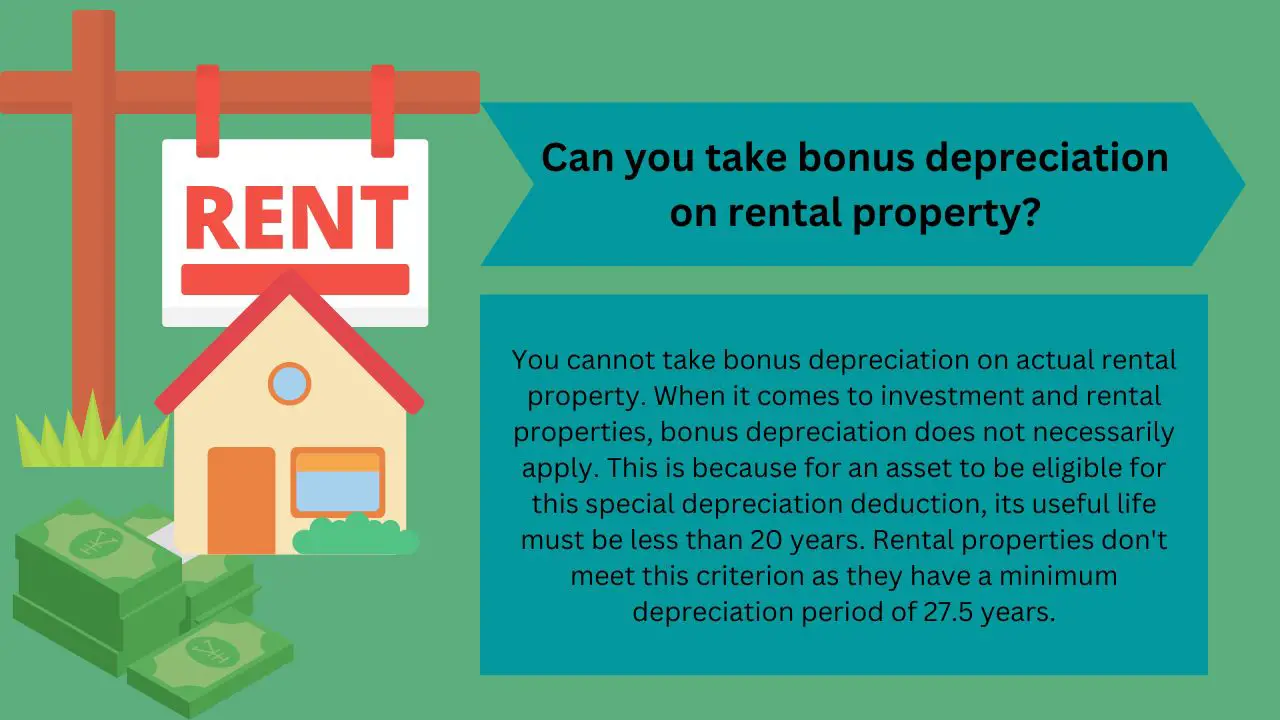

Can you take bonus depreciation on rental property? Financial, This limit is reduced by the amount by which the. Bonus depreciation allows businesses to deduct a larger portion of the cost of qualifying assets immediately, rather than spreading it out over several years.

Rental Property Bonus Depreciation Financial, Under the old law, section. For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000.